b&o tax credit

Direct your tax dollars back into your community. Dditional credits are available of up to 1000 every year.

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association

So if you went over and did work in Portland you would pay Oregon income tax and be able to claim a deduction for the gross receipts you made in Oregon.

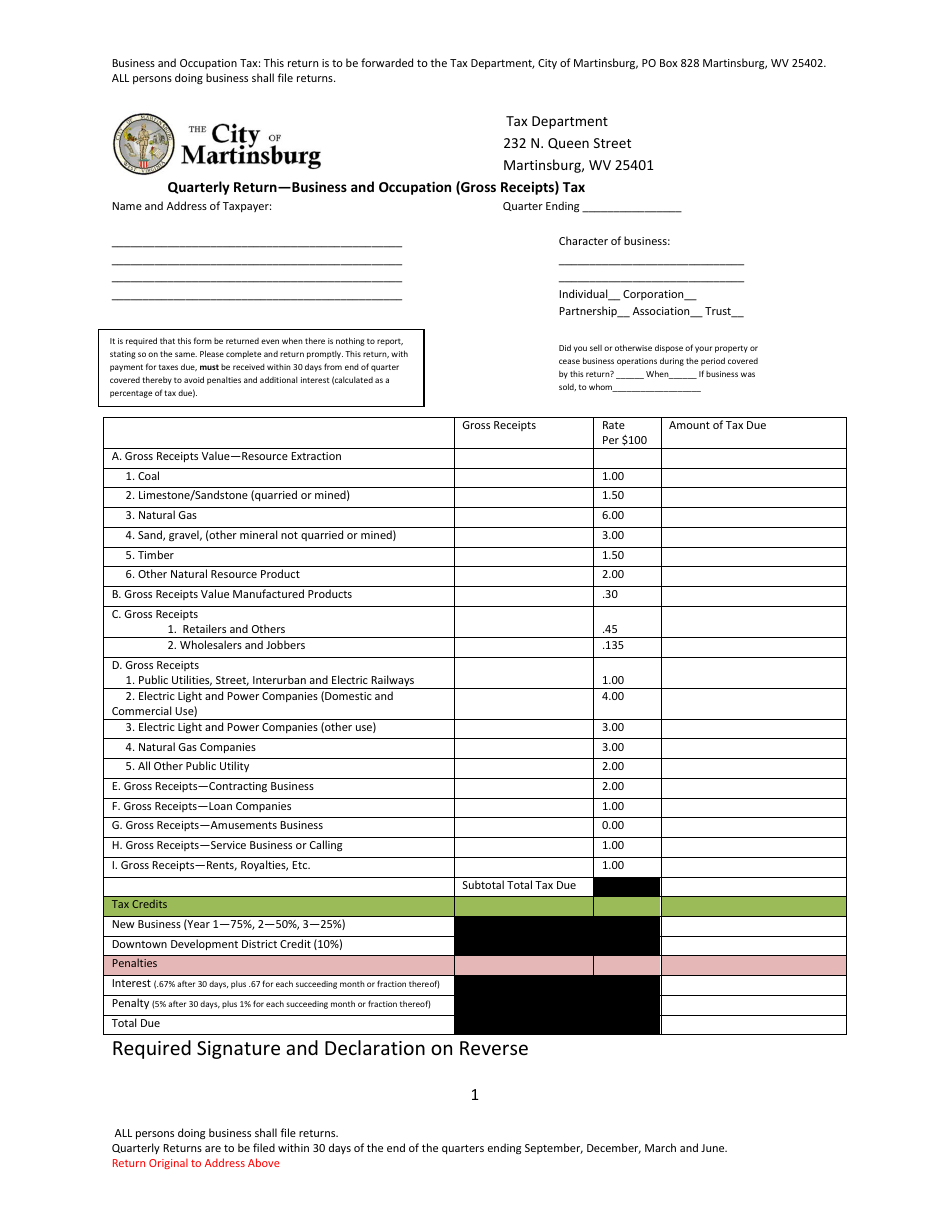

. Because Buckley Downtown Association is a 501 c 3 non-profit organizations other tax incentives may apply. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. This credit is commonly referred to as the small business BO tax credit or small business credit SBC.

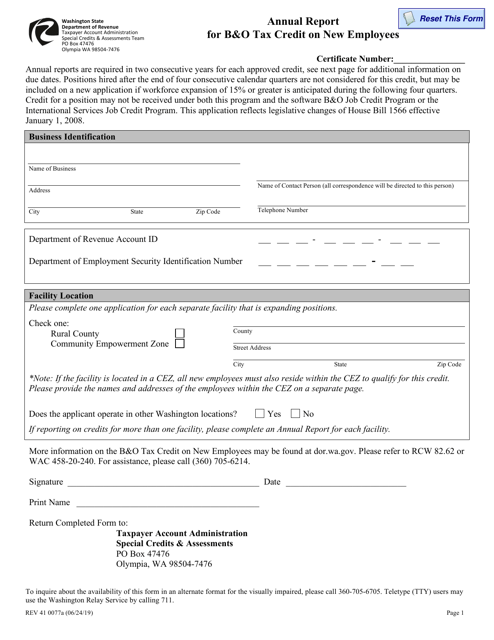

Business and Occupation Tax Credit A Business and Occupation BO tax credit is provided to businesses that make a contribution used for the development and operation of a downtown or neighborhood commercial district revitalization program. Keep that new position for at least five years if. A request for credit must be filled out and submitted online at wwwdorwagov.

The Small Business Tax Credit 720 applies if. The Main Street Tax Credit Incentive Program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. There are two credits available under the Small Business Tax Credit depending on your taxable income and total BO tax liability.

The Build Back Better bill would give EV buyers a 7500 tax credit through 2026 to charge up sales. The proposal would allow small businesses with fewer than 25. B O tax credit There are no deductions for business expenses except for income from a different state.

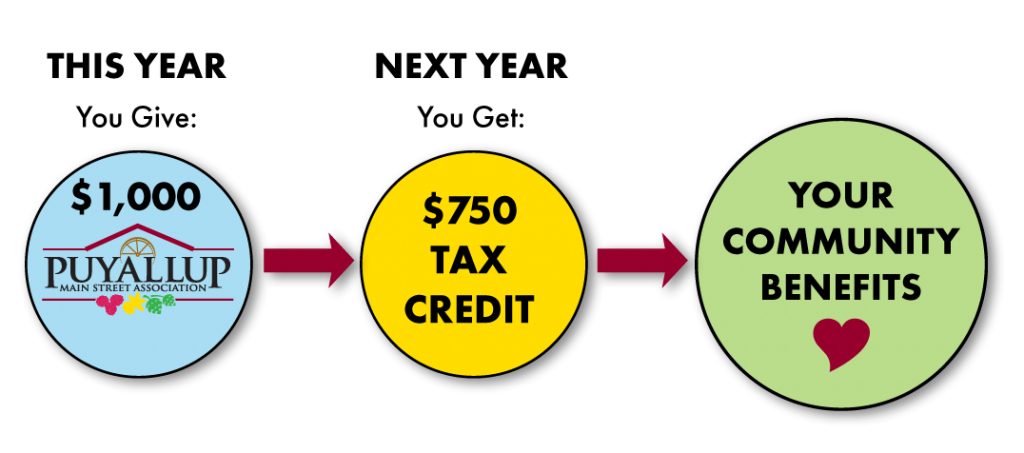

Make a pledge of as little as 1000 beginning January 11 2022 to Sumner Main Street Association pay the pledge to SMSA by November 15th and 75 of your pledge will be deducted from your. Get an extra 250 BO tax credit if the position meets the definition of a. Basic Facts About the BO Tax Credit Program.

Full-Time Employees For a full-time employment position to be eligible for credit it must be requested by. Wheeling Finance Committee Approves BO Tax Credit. For example if you extract or manufacture goods for your own use you owe BO tax.

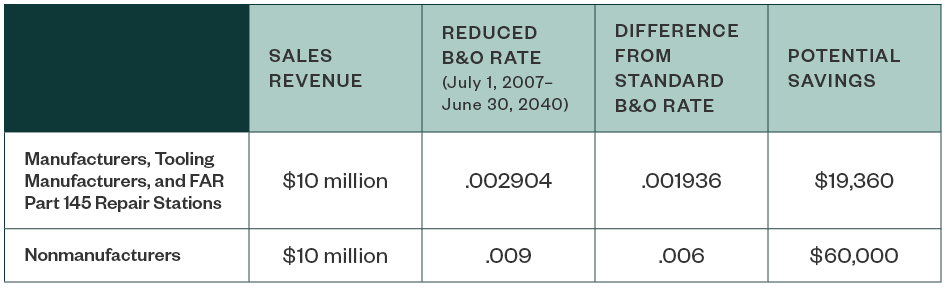

That means if you expand your workforce in Tacoma you can get a credit against the BO tax of up to 1500 annually. However your business may qualify for certain exemptions deductions or credits. Washington BO Tax Credits.

For this reason the Department of Revenue does not allow deductions for a Washington LLC or corporation paying the BO Tax. BO Tax Credit Program Direct your tax dollars back into your community Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. Eligibility Requirements - Section 78757 COVID-19 City Small Retail Business B_O Tax Credit.

Members of Wheeling City Council now will vote in early February on a one-time BO Tax credit program for small businesses that was approved by the citys Finance Committee early this evening. The Main Street tax credit incentive program provides a Business Occupation BO or Public Utility tax PUT credit for private contributions given to eligible downtown organizations. Eligible Main Street organizations can receive first quarter donations totaling up to 18518518.

500 Base Credit - Qualifying Position. Job Credits - You can receive a 500 BO tax credit every year for five if you. But the following year only electric vehicles made in.

Additionally a portion of your tax. New BO Tax Credit. 50 or more of your taxable income was reported under Service and Other Activities Gambling Contests of Chance For-Profit Hospitals andor Scientific RD and.

Pay that new employee at least Family Wageas developed by the Washington State Employment Security Departmentplus benefitscomparable to your industry no matter what kind of job it is. There is no income tax in Washington State. Donate 1000 and receive a credit of 750 applied to your 2023 BO tax obligation.

The amount of small business BO tax credit available on a tax return can increase or decrease depending on the reporting frequency of the account and the. Affidavit for Claiming COVID-19 Small Retail Business B_O Tax Credit. Eligible companies will have their credits subtracted from their BO.

Add an additional full-timeposition to your Tacomaworkforce. BO Tax Credit Program. There are however specific credits that are allowed for certain Washington corporations and LLCs.

Unlike the retail sales tax a sale does not have to occur for a business to owe BO tax. Businesses must be registered to file their state BO tax electronically. Get an extra 500 BO tax credit if the employee that fills the new position is a Tacoma resident.

The credit equals 20 percent of the wages and benefits a business pays to or on behalf of a qualified employee up to a maximum of 1500 for each qualified employee hired. Main Street Tax Credits are a way of ensuring your tax dollars are invested in your downtown community. B O Tax.

A business and occupation BO tax credit is available to businesses that employ an unemployed veteran in a permanent full-time position located in Washington for at least two consecutive full calendar quarters on or after October 1 2016 and before June 30 2022. The tax credit is. Take the credit against your Tacoma BO taxes each year and attach aJob heet.

Add a new full-time 35 or more hoursweek job to your Tacoma workforce. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization. Beginning October 1 2016 businesses that hire unemployed veterans may qualify for credit against their State business and occupation BO tax or public utility tax PUT.

You can get a 500 BO tax credit every year for five years if you. City of Wheeling West Virginia 1500 Chapline Street Wheeling WV 26003 304 234-3617. The credit is taken against the BO tax for each new employment position filled and maintained by qualified businesses located in eligible areas.

Check with your accountant for more information. Market Vines is a popular destination at Centre Market. Once your business donation request is approved by the Department of Revenue you are eligible for a tax credit worth 75 of the contribution to your downtown revitalization organization.

Up to 75 of your contribution to SDA in 2012 may be used against your 2013 BO or PUT tax liability. The BO tax for labor materials taxes or other costs of doing business. In order to take advantage of those dollars the state can offer a small BO tax credit which encourages donations to the 29 CDFIs operating in Washington state.

Maycumbers legislation prioritizes small businesses serving rural and. This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451.

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Main St Tax Credit Downtownmoseslake Com

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

B O Tax Program Puyallup Main Street Association

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

B O Tax Credit Incentive Program Downtown Waterfront

Business And Occupation B O Tax Washington State And City Of Bellingham

Form Rev41 0077a Download Fillable Pdf Or Fill Online Annual Report For B O Tax Credit On New Employees Washington Templateroller

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Washington Aerospace Tax Incentives

Projects Programs Kent Downtown Partnership